After a hurricane, maximizing compensation for both property damage and personal injuries is crucial. This guide navigates the complex process of understanding insurance policies, documenting storm-related injuries, and filing claims to ensure you receive fair reimbursement. Learn essential steps to navigate the aftermath effectively, including leveraging additional resources for financial recovery. By following these strategies, folks impacted by hurricane damage can secure a stronger financial foothold as they rebuild their lives.

Understanding Your Coverage: Deciphering Insurance Policies After Hurricane Damage

After a hurricane, navigating insurance claims for hurricane damage and personal injuries can be overwhelming. The first step is to understand your coverage. Start by reviewing your insurance policy closely. Note the types of damages covered, including structural repairs, personal belongings, and additional living expenses if you need to evacuate your home. Look for specific exclusions related to flooding or wind damage, as these may require separate coverage.

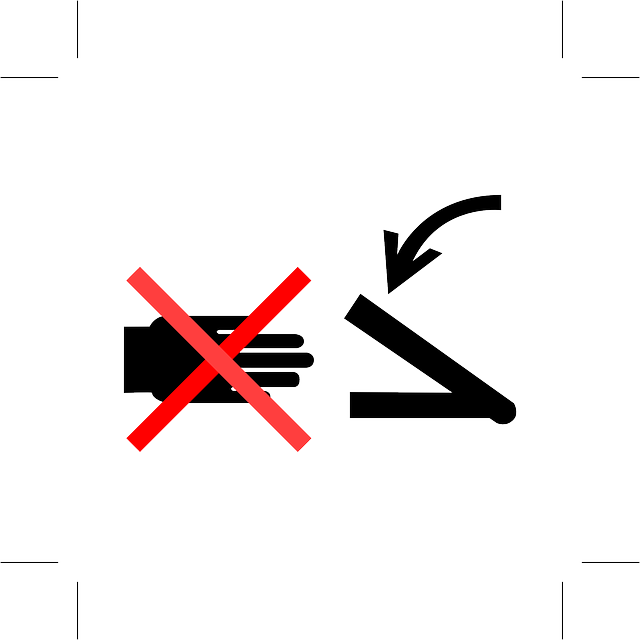

Check with your insurer to clarify what is considered covered under your policy. If you’ve sustained hurricane damage and personal injuries, document everything thoroughly. Take photos of the damage, keep records of expenses incurred, and seek medical attention for any injuries promptly. This documentation will be crucial when submitting your claim, ensuring you receive fair compensation for both the repairs and your well-being.

Documenting Personal Injuries Sustained During the Storm

Navigating Claims: Steps to Maximize Compensation

Navigating a claim for hurricane damage can be overwhelming, especially if you’re dealing with personal injuries. Here’s how to maximize your compensation:

First, document everything. Take photos and videos of the damaged property and any personal injuries sustained. Keep records of all medical treatments and expenses related to these injuries. Additionally, gather all relevant documents, such as insurance policies, communication with insurers, and estimates for repairs or replacement items.

Next, communicate clearly and promptly with your insurance company. File a claim as soon as possible and provide them with the documented evidence. Be thorough in describing the extent of the damage, including any personal injuries, and keep records of all conversations and correspondence. Consider seeking legal advice if the process becomes complicated or you feel your rights are not being respected.

Additional Resources and Support for Financial Recovery Post-Hurricane

After navigating the challenges of hurricane damage, understanding your insurance coverage and taking proactive steps to document personal injuries and maximize compensation is crucial. By deciphering complex policies, documenting every injury sustained during the storm, and following the right claims process, you can ensure a smoother financial recovery. Remember that maximizing your compensation isn’t just about the money; it’s about ensuring your needs are met and receiving fair reimbursement for any losses incurred due to hurricane damage and personal injuries.